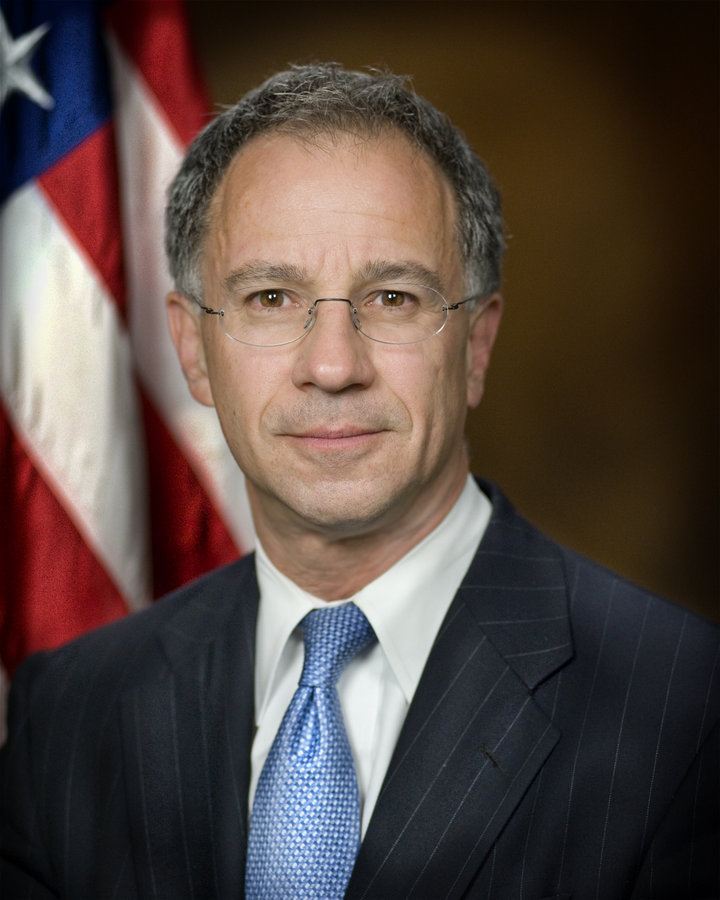

HOBOKEN—A Hoboken-based financial consultant has pleaded guilty to evading payment on taxes on income totaling around $273,000, according to a statement released by the office of U.S. Attorney for the District of New Jersey Paul Fishman.

In a Newark federal court on Monday, John Twomey Booth admitted to willfully attempting to evade the payment of federal personal income tax for calendar year 2008.

Booth, 66, offered financial consulting services in Hoboken and elsewhere. Between March 2006 and December 2009, he accepted hundreds of thousands of dollars in payments from an insurance broker based in Towson, Maryland, according to documents filed in this case and statements made in court.

The broker’s companies provided services for both the Weehawken Board of Education and the Union City Board of Education, among other New Jersey municipal entities, court documents alleged.

Booth neglected to report around $719,000 in income to the IRS for the years 2006, 2007, 2008, and 2009, according to documents and statements introduced in court. However, the count to which Booth pleaded guilty dealt specifically with roughly $273,000 in commission payments from the Towson insurance broker.

Booth was responsible for paying $119,731 in taxes on those payments.

Booth’s sentencing hearing is scheduled for Dec. 15, 2014. The maximum penalty he can be given for the tax evasion count is 5 years in prison and a $250,000 fine.

The U.S. government is represented in the case by Assistant U.S. Attorney Lee M. Cortes Jr. Booth is represented by New York attorney Richard Lawler.

Our Digital Archive from 2000 – 2016