Be patient. That’s what the administration of Mayor Steven Fulop and his allies on the City Council are telling residents after introducing an amended 2013 municipal budget that will include a tax increase.

The revised $515.9 million budget was unanimously introduced during a special council session held on July 10, and will come up for a vote before the council this week. The revised budget is likely to be adopted.

This municipal tax increase comes on top of other increases by Hudson County and the local school district. Property owners in Jersey City pay a tax rate determined by a combination of three budgets: The city budget, the school budget (determined every April) and the county budget (usually struck in June).

Taken together, property owners will pay a combined increase of 3.92 percent this year in taxes. (The municipal portion alone is going up 7.6 percent this year.)

Despite grumbling from some residents on social media sites, few will have an opportunity to speak publically about the revised municipal budget, which will translate into a tax increase of $250 per year for the average property owner. As is standard procedure when such items are introduced, there was no public hearing on the budget at the council’s July 10 meeting. While a public hearing will be held this Wednesday, on July 17, that City Council session takes place during the day and begins at 10 a.m. when many residents will be at work.

The daytime session was scheduled by the council months ago, in January, when there was no way to predict that the budget adoption meeting would coincide with one of the council’s few daytime meetings. Still, the timing may shield the council members from having to hear from tax-weary property owners who hoped the Fulop era of promised fiscal conservatism would come sooner rather than later.

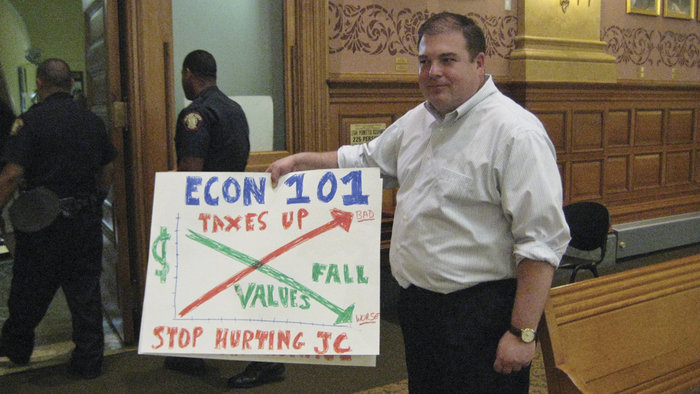

“They ran on a platform that they were going to limit city spending and keep taxes low,” said downtown resident Fletcher Gensamer, who ran in May for the Ward E City Council seat, referring to Fulop and his City Council allies. Gensamer attended the special council meeting and held up various protest signs throughout. “I want to know what happened to that promise? I want to see cuts. I want to see layoffs.”

Where it comes from

Of the city’s revised budget of $515.9 million, Budget Director Robert Kakoleski said $217 million will be generated from property tax dollars.

On a property worth $93,500, Kakoleski said a property owner will pay $17 more in county taxes this year; $34 more in school taxes; and $250 more in municipal taxes. When added to previous tax increases approved by the county, school district, and city in years past, these new increases mean the average property owner is now paying roughly $6,984 in taxes, total, on a property worth $93,500, Kakoleski said.

Ward C City Councilman Richard Boggiano said such numbers will tax people out of Jersey City. Boggiano was elected to his seat in a runoff election held last month.

“This is outrageous,” Boggiano said to Kakoleski at the July 10 special meeting. “The city can’t just keep raising taxes like this. We are going to make this city too expensive to live in. People cannot keep paying these kinds of taxes, especially our senior citizens. Taxes like this are going to scare people away.”

Gensamer agreed.

“When taxes go up, property values go down,” Gensamer said, pointing to one of his protest signs. “I bought when the market was high, so I’m already paying high taxes. First Fulop cancelled the property reval, which would have helped lower my taxes. Now I’m being hit with a tax increase.”

(Hudson County officials last week cast some doubt on whether Fulop can cancel the property revaluation without county and state approval. For more, see briefs, on page 2.)

In response to Boggiano, Ward F City Councilwoman Diane Coleman said, “I think if you look at Mayor Fulop’s transition report. Which was released [on July 10], I think you will see several revenue generating ideas that will help the city budget next year.”

Inherited costs, revenue shortfalls

Mayor Fulop and his allies – who were sworn in to office on July 1 – said they had no choice but to raise taxes after inheriting a budget from former Mayor Jerramiah T. Healy that has several revenue and spending miscalculations.

For example, the hoped-for sale of a 2.5-acre plot of municipal land next to Jersey City Medical Center is unlikely to happen this year. The city had hoped to raise $12 million from the sale of that land.

The city initially expected to generate another $1.2 million from legal settlements and judgments, but is now on track to raise a slightly lower figure of $1 million.

A $2 million surplus had already been spent by the end of May, Kakoleski said, although a portion of this surplus may be restored by the state.

While these anticipated revenues have gone down, a few city expenses have increased, Kakoleski said.

For instance, the city will have to pay an additional $250,000 for the recent municipal and runoff election. About five-eighths of this amount will be reimbursed by the state.

The city’s debt service (interest) was also affected by the federal sequester in Washington, D.C. earlier this year to the tune of $500,000. Most of this is for Gold America Bonds that are being used to help build the new Department of Public Works complex, Kakoleski said.

The city will also have to pay $275,000 in matching grants that it has received since the budget was first introduced in February.

Finally, Jersey City’s emergency authorization budget line item had to be increased by an additional $1.1 million.

“If you add up all those changes, and some other little things within the budget, we have a $16 million [increase] in the amount to be raised by taxation,” Kakoleski told council in May.

The $16 million shortfall outlined by Kakoleski is in addition to another $5 million the Fulop administration will have to find to cover benefits owed to about 27 senior Jersey City Police Department personnel who will retire during the second half of this year.

Salary, wage increases

The eight-page budget amendment introduced last week includes several line items of note.

Wages and salaries in the mayor’s office will be upped from $929,650 to $1,029,650 – an increase of $100,000. Wages in the revamped Mayor’s Action Bureau will increase by $180,137, from $366,863 to $547,000.

The city’s website touts a “new and improved” Action Bureau whose “goal is to provide [residents] with quality information, courteous customer service, and quick turn-around on quality-of-life complaints.”

Details on how Mayor Fulop plans to overhaul and improve the Mayor’s Action Bureau have yet to be released. But during a series of town hall meetings Fulop held throughout the city in June, many residents expressed a desire for better constituency services from municipal departments. An expanded Action Bureau may be Fulop’s attempt to address these criticisms.

Salaries in the city’s law department will also be increased under the amended budget, from $2,998,221 to $3,173,221 – an increase of $175,000. There will also be salary and wage increases in the city’s Department of Public Works and in the Department of Housing, Economic Development, and Commerce.

E-mail E. Assata Wright at awright@hudsonreporter.com.