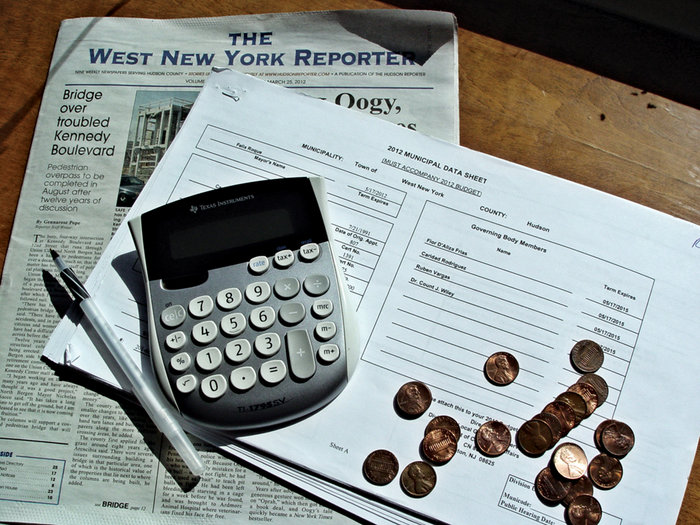

After a four year history of tax increases, the first municipal budget of the new West New York administration reflects a 1.2 percent drop in residents’ tax bills for the 2012 calendar year. Commissioner of Revenue and Finance Caridad Rodriguez says that over the course of those four years, taxes had been raised 51 percent.

“We think of it as a business and a household,” Rodriguez says, “except there’s no credit cards we can use. We’ve managed to work the best we can with minimal amounts.”

The 2012 $69.9 million budget covers municipal spending from Jan. 1 through Dec. 31, 2012. It is down slightly from the previous year’s $71.8 million spending plan, and was presented during a hearing on March 21. It will be voted on after a hearing on April 18.

Residents pay an overall tax rate derived from the budgets of three entities: the town, the schools, and the county. This budget affects only the town portion. With this factored in, the overall tax rate that includes all three entities will drop 1.2 percent from last year’s overall rate.

That means that this year, West New York’s taxpayers will pay $64.89 for every $1,000 of the assessed valuation of the property they own. So someone who owns a house assessed for $200,000 will pay $12,978 over four quarters.

“We’ve managed to work the best we can with minimal amounts.” – Caridad Rodriguez

____________

Town budgets are often voted on late in the year as towns wait for state aid and other deals to go through, but this year, Rodriguez said, they’re able to vote early because they began early. The budget that will be voted on later this month has been presented and amended several times.

Behind the budget

Because state aid to West New York is expected to decrease from $9 million in 2011 to only $6.8 million for 2012, there were several adjustments necessary to produce a tax decrease for residents, Rodriguez explained.

In addition, while expenses paid to North Hudson Regional Fire are anticipated to increase by $190,000, costs were cut elsewhere to compensate.

One seasonal factor was the sparse snowfall this past winter, which will contribute to the anticipated budget surplus of around $5 million. Part of this surplus is a holdover from 2011’s surplus of $6.1 million.

Back in January, the police department promoted six officers to a higher rank, but each one deferred a raise for a year in order to help balance the budget. Also, new town officials who are hired will receive a salary that is 30 percent less than what previous new hires were paid, Rodriguez stated.

The town secured $70,785 in Urban Enterprise Zone funds for litter clean up. Urban Enterprise Zone is a designation given by the government to towns who require extra tax relief and aid.

Waterfront ratables (property taxes) are anticipated to account for $14 million in revenue; and alcoholic beverage licensing is anticipated to bring in $115,000, up from $90,000 in 2011.

The town anticipates $1 million in Formula One Race contractual revenue: an amount the town will receive for the construction and preparation necessary for the 2013 Formula One race set to run along Boulevard East and the waterfront in West New York and Weehawken.

“We really focused on money this year as an administration,” Rodriguez said. “We took the community’s needs to heart and did our best to provide some relief, despite these economic times.”

The budget will be voted on during a Board of Commissioners meeting on April 18 at 7 p.m. in the conference room at Town Hall located on 428 60th St.

Gennarose Pope may be reached at gpope@hudsonreporter.com