An international organization founded by a Nobel Prize laureate and known for giving very small loans to micro-businesses hopes to expand into Jersey City.

If successful in attracting the seed money it needs to open a Jersey City office, the organization, Grameen America, could eventually help food cart vendors, flower salespeople, hair dressers, and other small entrepreneurs get the capital they need to get their businesses up and running.

Representatives from Grameen America are currently reaching out to foundations, nonprofits, community-based organizations, the business community, and other potential donors to get seed money needed to open a lending branch in Jersey City.

The organization needs about $83,000 in hand to get going according to Howard Axel, director of National Donor Relations for the organization.

‘Even that little bit of money can get you over the top.’ – Nicole Gates

____________

8 million borrowers and counting

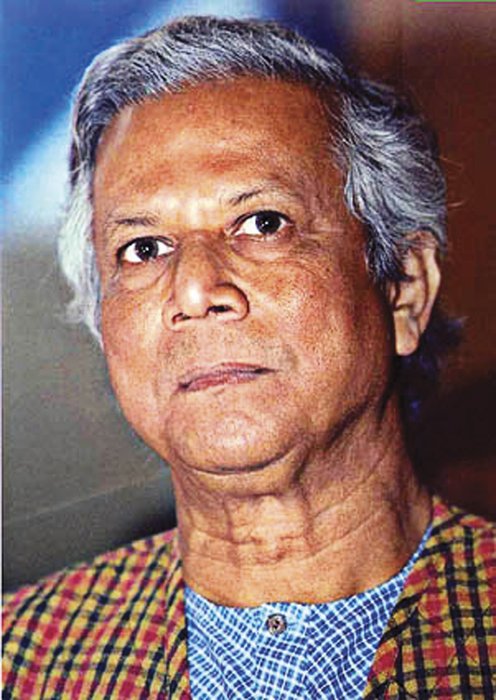

Grameen America, a New York-based nonprofit, is trying to achieve in the U.S. some of the goals achieved in Bangladesh by the Grameen Bank in the mid-1970s. Conceived by Muhammad Yunis, an economics professor at the University of Chittagong, the Grameen Bank Project began in 1976 to offer small loans and what Yunis called “microcredit” to poor, rural entrepreneurs who were not able to access these services from traditional banks.

Between 1976 and 1979 the Grameen Bank Project made very small loans to poor would-be businesspeople based on trust, rather than collateral or traditional standards of credit worthiness. Borrowers were required to join community-based peer groups that helped them meet their repayment goals. Despite the poverty of these entrepreneurs, the bank had a loan repayment rate that was above 95 percent.

As of October 2011, Grameen Bank had given loans to more than eight million borrowers, most of whom were women. By that year the borrowers had a repayment rate of 96.67 percent. In 1983 Gramen became a formal bank, with 10 percent of the equity owned by the government of Bangladesh, the remaining 90 percent of which is owned by the borrowers, who are now bank depositors. Today, the bank has approximately 2,565 branches in 81,379 villages.

Yunis would go on to be awarded the Nobel Peace Prize for this work in 2006.

Adapting the model stateside

In 2008, Yunis decided to adapt the Grameen Bank model for the U.S. The lending model here works differently than it does in Bangladesh. Here, Grameen is not a bank but rather operates as a nonprofit organization.

Businesspeople are given loans of roughly $1,000 to start and are required to meet weekly with small peer groups that help them meet their repayment schedules. As in Bangladesh, borrowers need no collateral or credit history to receive a loan. Most loans are repaid within six months to a year. After repaying their initial loan borrowers are eligible to receive another loan for a larger amount.

“A lot of the businesses we make loans to are home based businesses where the business owner is trying to take that next step,” said Axel. “You might have someone who is doing hair styling in their home and they want to be able to go into a salon. Well, to do that they typically need to rent space within a salon. So the Grameen loan might cover the cost of that rental. Or, in most cities there are all kinds of fees and licenses one needs to operate a business. Our loans can help cover the costs of those licenses and fees.”

Grameen America borrowers have a default rate of about two percent, according to Axel. Borrowers are required to go through a five-day financial literacy training and are also required to have a savings account.

The organization currently has branches in Omaha, Nebraska, Indianapolis, Indiana, in addition to the Bronx, Brooklyn, and Manhattan. The organization is currently planning to open additional branches in Jersey City, New Jersey, California, North Carolina, Massachusetts, and Washington, D.C.,

Most borrowers report that they used their initial Grameen loan to purchase inventory needed for their business operations.

In a video posted on YouTube, Brooklyn caterer Nicole Gates, owner of Soul Sister Cuisine, said she used a $1,500 Grameen loan in 2009 to “purchase my tents, my grills, and all the other different equipment I needed to do my [first] outdoor fair…Every little bit counts. Even that little bit of money can get you over the top. Grameen did that for me.”

When Gates made her YouTube clip she had already repaid the initial $1,500 loan and was working on her second Grameen loan.

E-mail E. Assata Wright at awright@hudsonreporter.com.